The future of payments: get the most out of BLIK!

If you’re from Poland, you probably heard about the BLIK payments method. This is an intuitive and efficient way of sending and receiving money that actually may start revolutionizing the banking industry all over the world.

What is BLIK? How did it get so popular? Or why should you take a closer look at this payment method? How can it change the whole sector?

So many questions – and we have all the answers below.

What is BLIK?

BLIK has revolutionized mobile banking in Poland and is the most popular mobile payment method in this country. With this solution, users can use their smartphones to make payments using cashless wallets. All major Polish financial institutions use the BLIK system embedded in their banking applications.

In February 2015, six banks in Poland launched this service.

By using the app, smartphone users can make cashless payments at stationery stores and online retailers, withdraw and deposit cash at ATMs, make transfers, send money to a designated phone number – all using a digital code.

And numbers speak for themselves.

According to the National Bank of Poland, in 2019, the number of BLIK transactions exceeded the number of transactions made with payment cards on the Polish Internet. BLIK users performed over 153 million transactions from January to March 2021, almost twice as many as during the same period in 2020. And in Q2 2021, more than 8 mln people have used BLIK (source in PL).

As of now, BLIK is currently available to over 90% of all Polish financial institution customers, in the apps of dozens of banking and financial institutions, as well as payment gateways.

How can users leverage BLIK?

First of all – to use BLIK, you do not need to sign up anywhere. This is an important step towards

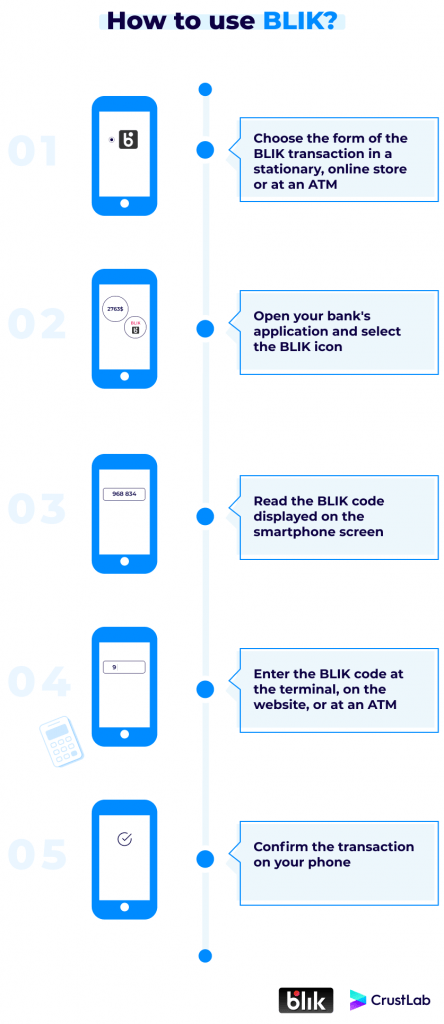

But, how exactly can users leverage BLIK to make payments?

Your bank’s app, your device, and an internet connection are all you need.

The BLIK payment method is widely used by users to pay in brick-and-mortar stores, online stores, or cash machines. They choose BLIK as a way of paying and navigating to their mobile banking app to download the code upon clicking on the “BLIK” icon. The authorization code is 6-digit long – if it expires, a new one can be generated (usually, the two minutes span is more than enough).

Users provide the code directly in ATMs, through payment gateways or payment terminals. Then all that’s left is to confirm the transaction using a quick push notification coming through the device.

It usually takes a few seconds to complete the process – compared to other methods of payment, it is nothing.

Why is BLIK so popular?

The popularity of this system is primarily due to demands, both online and offline. Since the pandemics forced quick, cashless, and contactless payments, BLIK became increasingly relevant.

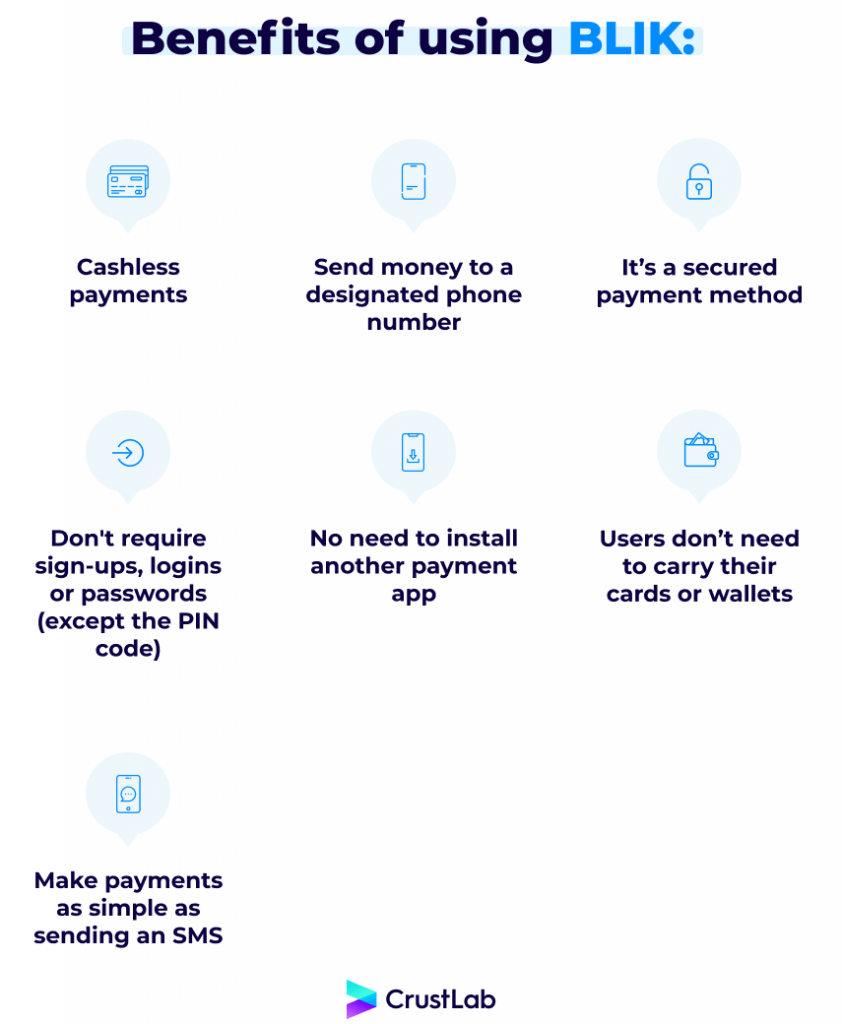

Also, there was no new application created for BLIK. Instead, BLIK was integrated into existing mobile banking applications. This is another convenient option for users who aren’t required to install any additional software.

Through its straightforward interface, BLIK enhances the functionality of bank applications in which it has been implemented. That is one of the reasons BLIK has gained popularity not just among end-users, but also among financial institutions who see it as a competitive advantage.

Benefits of using BLIK

#1 Users don’t need to carry their cards or wallets

With BLIK, it’s simplified. This issue is so much more than simply not having to insert your cards into a slot: with BLIK, a single user won’t even have to carry a wallet.

Instead, they can pay with their smartphones.

Blik eliminates the need to look up special bank codes, use a browser to access your e-account, and carry cards.

#2 It makes payments so easy

In fact, you can use BLIK nearly everywhere in Poland now.

With the BLIK mobile payment system, you can make payments online quickly, withdraw cash from an ATM, make contactless payments for purchases in a shop, and send money between phone numbers.

As a result, you don’t have to remember your friends’ long bank account numbers when sending money to them. You only need their phone number, since you send money through it. The transaction takes place almost instantly. The goal is to make payments as simple as sending an SMS.

The use of BLIK increases business credibility and, at the same time, makes it easier for the buyer to complete transactions.

#3 It’s a secured payment method

Using the BLIK mobile payment system is safe. Both the BLIK payment service and the application itself have a number of necessary security features.

First of all, to log in to the mobile application, you must enter the PIN code provided during activation. Transactions made with the BLIK code must be confirmed with the “Accept” button or with the PIN code. These extra steps of security take only a few seconds yet protect the whole process.

The BLIK system generates a one-time code that is displayed in the mobile banking application on the customer’s phone. The code must be entered into the terminal in the shop, on an ATM keypad, or on the mobile device screen. Also, your transactions cannot be made without authorization on the smartphone.

So, payment for goods using this system on the phone is extremely simple and safe because it does not require any data or passwords for electronic banking (except for the PIN code).

How can you make use of BLIK?

#1 When you want to withdraw money from an ATM

Cash withdrawals from BLIK ATMs are the same in almost every bank. To withdraw money from an ATM with BLIK, you need to find an ATM that accepts BLIK withdrawals. They are marked with the BLIK logo.

Select “BLIK Withdrawal” in the ATM. Enter the amount you want to withdraw. Then, the BLIK code will be displayed on the smartphone in our bank’s application – and must be entered on the ATM screen. After that, you will be asked to confirm the transaction in your banking application. If everything is correct, the ATM will withdraw the amount you requested.

#2 When you wish to pay in the offline and online shop

Shopping in the offline store is possible with cash, card, phone, and BLIK. All you have to do is ask for the BLIK payment when you finish your shopping. Then the salesman will ask you to enter the code on the terminal. You need to generate the code, confirm it on the terminal and in the bank’s app.

Also, feel free to use BLIK in online payments. Choose from the available options to pay this way. Then generate the BLIK code and enter it in the right field on the page. Finally, confirm in the bank’s app and you’re done.

There is an even faster BLIK payment method for online purchases that don’t require a code to be downloaded. When confirming the transaction, the browser or a specific website of the store must be marked as a trusted website. Once you have remembered the page, you can pay with the PIN by simply confirming the transaction.

#3 When you want to send money to the phone number

With BLIK, you do not need to know the account number you want to send money to. All you need is the recipient’s phone number – enter it yourself or select it from the list of contacts on your phone. The BLIK icon next to the phone number in the contact list in the application will show you whether your friend can receive a BLIK transfer to the phone. If so, choose this money-transfer option. Then, fill in the remaining data and confirm the transfer.

The cash will reach the recipient’s account immediately on weekends and holidays. Of course, it costs you nothing, because the transfer is free.

To receive money this way, you need to register your phone number in the mobile app. So log in to the Bank’s mobile application. Next, go to BLIK settings and select phone transfer settings. Finally, choose the default account for BLIK transfers to the phone.

BLIK for the financial institutions

BLIK is a fast and convenient payment method that allows customers to make payments using their mobile phones. It is also a very safe and secure way to pay, as it uses advanced security features to protect users’ personal and financial information. Financial institutions can benefit from using BLIK in many ways, including reducing fraudulent activities and increasing customer satisfaction. Overall, BLIK is a great payment option for both businesses and consumers.

It is a relatively new payment system that allows for instant payments. It is faster, cheaper, and more efficient than the existing systems, and it has the potential to revolutionize the way financial institutions operate.

The main benefits of using BLIK are speed, efficiency, and cost savings. With BLIK, banks and other financial institutions can facilitate instant payments, which saves time and money for their end-users. In addition, BLIK is more efficient than the existing systems, so it reduces the costs of doing business.

Is BLIK the future?

We shouldn’t be surprised that BLIK is going to focus on making contactless payments available around the world primarily. Another goal is to establish partnerships with foreign platforms that will provide payment solutions to global e-commerce platforms.

Therefore, BLIK intends to expand its network far beyond Poland and cooperate with foreign banks to offer its services as a payment method to their customers – users of banking applications around the world.

BLIK is a great example of how banks can use technology to improve the customer experience. By implementing BLIK, the financial sector can make it easier and faster for customers to pay for goods and services.

Plus, BLIK is a secure payment method that protects both consumers and businesses from fraud – so if you’re a financial company looking to improve your customer experience, BLIK is a great option to consider.