TMS Brokers – Online currency exchange office

TMS Brokers virtual currency exchange office

TMS Brokers was the first Polish currency brokerage house with a 20-year history on the local market and recipient of many industry awards. TMS Brokers has a team of specialists who assist clients with their investments in global financial markets by providing innovative tools, consulting, and education in the field of financial investments. Their collaboration with CrustLab was initiated by Tomasz Stosio, Director of the Payment and Currency Exchange Department at TMS Brokers.

Virtual currency exchange office challenges

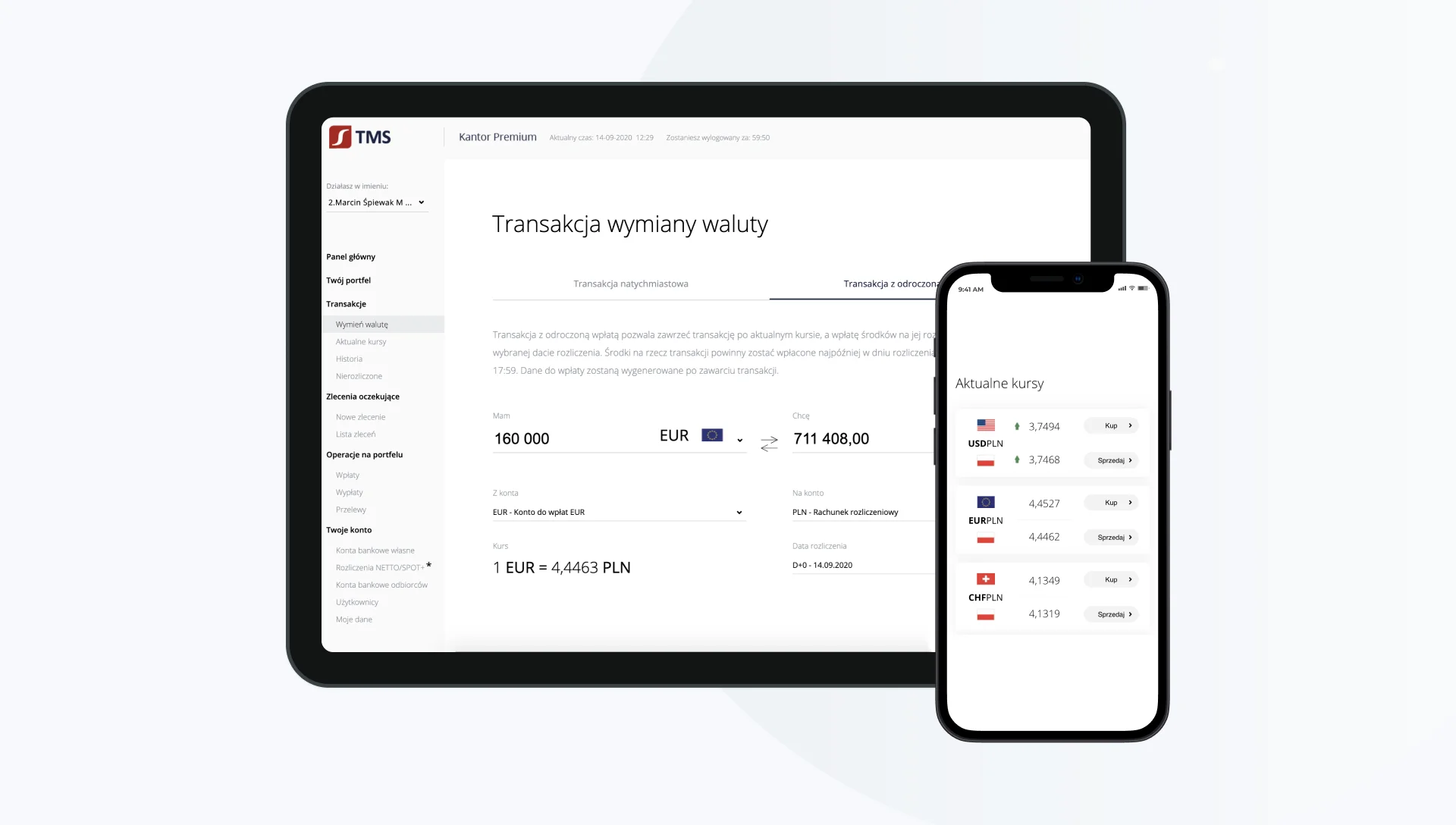

The main challenge of this project was to expand the user panel’s functionalities and other elements on the currency exchange platform. The changes were needed to streamline and automate the currency exchange process for users, as well as to enable them to perform new types of transactions. Companies using the platform required the option to create accounts for employees with various roles and grant them the necessary permissions for their work. We transferred new functions from the admin panel to the user panel.

The trading panel shows the overall cash flow through the platform and is a section of the platform in which TMS Brokers employees monitor exchange rates on an ongoing basis and may purchase currencies according to current demand.

TMS Brokers face the endless challenge of maintaining, continually optimizing, and developing this platform, so we will continue to work together for the foreseeable future.

How we build a virtual currency exchange office

As required, we started our work on implementing new functionalities to be available from an individual customer’s perspective. Thanks to this, the user panel gained tools that allow for even more effective currency exchange. At the platform users’ request, we also introduced new types of transactions (SPOT+ and NETTO) and authorization of transactions via SMS. We optimized integration with banks (PKO BP, Alior, Santander) and started working on others (e.g mBank), as well as on the ability to share an account and assign roles to individual users, granting them new opportunities.

The next step in our cooperation was implementing the currency wallet, i.e. the administrator panel used by TMS Brokers employees. Moreover, employees of TMS Brokers gained insights into the process of new user registration and can now react when the process is interrupted by the user.

Key Takeaways

- Bug fixes – we significantly improved the platform’s performance by fixing bugs in all four panels.

- New functionalities – we added several new functionalities that were needed both by clients and employees of TMS Brokers.

- Integration with banks – we optimized integration with external banks and are continually adding more.

Results

Although our collaboration has been pretty short so far, the results are already visible. First of all, we have introduced new functionalities for individual clients and companies, including new types of transactions, expansion of the admin panel, integration with banks, the option to add a deposit, and authorization of critical actions on the website via SMS. We have also optimized the platform’s operation by fixing bugs, reducing the risk of new ones occurring, and improving the entire deployment process. Moreover, our improvement of automatic payments accounting has made the accounting department’s work easier.