API Banking: How to implement it on FinTech client example

Everywhere we look around us, we can find APIs. For example, a restaurant’s website may have embedded Google Maps, so you know where to find it. That’s done using an API. And if you’re reading an article and you see live tweets with further information, that’s made with the help of an API as well.

But the real revolution is coming with the introduction of API Banking. With it, banks can now provide a better digital experience to their customers while also ensuring their data is perfectly safe. But the API access also allows them to work now together with the Fintech companies and for example, embed their banking APIs into non-financial apps.

That way, having an Open Banking API can increase a bank’s appeal and allow them to respond to quickly changing customer demands. But what is it, and how does it work?

In this blog post, we will discuss all you need to know about API banking. So if you’re ready to take your business to the next level, read on!

What is API banking, and how does it work

Basically, an API (Application Programming Interface) is an interface through which it’s possible to sync, link, and connect the service database with any application. You can say they serve as a bridge between an app and service that ensures data transmission in a secure manner without involving third parties.

API banking meanwhile refers to a set of protocols that makes a bank’s services available to other third-party companies via API. In this way, banks and third-party companies can combine their offerings and offer a much wider range of services to their customers than they could otherwise.

One of the most common examples of using an API in banking is creating a mobile banking app for customers. Those apps allow customers to check account balances, transfer money, pay bills, and more, straight from their phones. But customers can also use these applications to track their spending, budget better, and find new ways to save money or buy additional services offered by third-party companies.

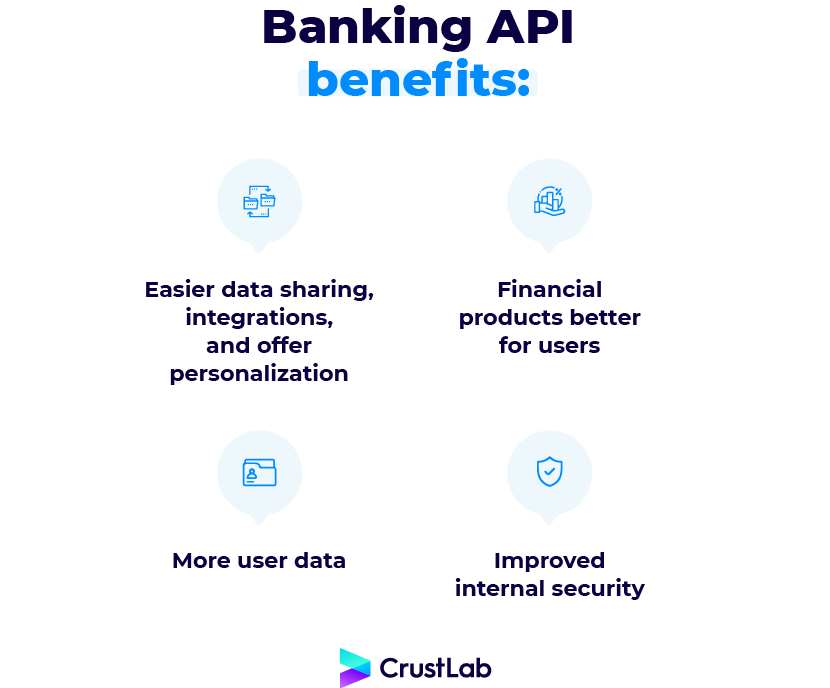

The benefits of using API banking

In 2021, 47% of banks and credit unions (CUs) have invested in or developed APIs, up from 35% in 2019. Another 25% plan to invest in this technology in 2022. But just what makes banking API so appealing?

Perhaps the most obvious benefit is that APIs make it easier for banks and other financial institutions to share data, integrate with systems, personalize their services, or add new services to their offering. So now, when data transparency and easy sharing between parties are crucial, banking API allows companies to do exactly that while also improving internal security (all banking APIs have to meet strict compliance and security requirements).

But there are a couple of other benefits: the vast amount of data the API can gather and store can be a goldmine of information for the banks and help them tailor their service to the customers’ expectations. The more personalized the products and services, the less your customers turn to your competitors. And since the data is collected automatically, you don’t need any more to spend time managing the data yourself.

Collaboration with other banks and third-party institutions can also prove to be incredibly profitable. By gaining access to user data from other participating financial institutions (particularly other banks), banks can market their products and services to a much wider audience. This opens up a world of potential for banks to develop their own integration-based financial services.

In addition to being extremely useful for businesses, APIs are also very helpful for consumers. Using an app saves time spent on transactions, makes any service or product a consumer might need straight away, and helps them with managing their finances.

Those apps also helped reduce many administrative hurdles for the customers, such as the paperwork needed to apply for a loan or check their creditworthiness, making banking services more accessible than ever. Being able to access other related services they might need (like insurance) straight from the app is also a massive time-saver for the customers – they don’t need to spend time searching for a provider, they can have a tailor-made offer for them available straight from the app.

With all those benefits, is it any surprise that experts predict that by 2026, the global Open Banking market is expected to reach $43.15 billion?

How we do it: API banking x TMS

Now, what does building such an API look like? We could go through the theoretical steps of creating one, but instead, we’ll show you an example of one by looking at how we built an online currency exchange API for TMS Brokers company.

What was the project?

TMS wanted to enhance its online virtual currency exchange office with new functionalities for the users, such as new types of transactions and ways of authorizing those. It was especially important for them to improve onboarding and exchange processing.

What was the challenge?

This project involved expanding the user panel’s functionality and other elements of the currency exchange platform. The company’s main goal was to streamline and automate the currency exchange process for the users and give them new types of transactions to use.

What is the outcome?

We have added new features for individuals and companies to the app, including:

- New types of transactions (SPOT+ and NETTO)

- An expanded admin panel

- Bank integrations (PKO BP, Alior, Santander)

- The option to make deposits,

- SMS authorization of critical actions,

- The option to share an account and assign roles to individual users,

- A widget that allows partners to present TMS platform courses on their websites,

- A feature that allows monitoring the flow of money within the organization,

- Accounting process automation,

- Enabling partners to execute transactions using an open API.

Our team has also optimized the platform’s overall work by fixing bugs, reducing the likelihood of new ones occurring, and optimizing the deployment process. Currently, we are working on full internationalization of the application and adapting it to enter the English-speaking markets, plus implementing a Polish product to one of their product.

We also keep working with them on maintaining, optimizing, and developing this platform.

The future of API banking

While banks and financial institutions looked at API banking with some dose of reserve and hesitation at first, the benefits of those speak for themselves. From frictionless payments to more secure and simple ways of paying, there are enormous benefits for merchants, payment providers, open banking operators, and consumers alike.

That’s why more and more banks and financial institutions but also Fintech companies, are joining the trend. The number of new Open Banking customers has increased by 60% over the last year, totaling 3.9 million consumers and 600,000 small businesses. With 1 million regular and active users joining Open Banking every 6 months, it now has over 4.5 million regular users.

And this is just the start – what more can we expect to see from banking API technology?

Globalization of FinTech industry thanks to modern tech solutions, including API banking

The digital transformation that was supposed to take a decade is happening right in front of our eyes – and API banking is one of the best examples of a Digital Transformation of the financial industry in recent years. Banking apps, “Buy now, pay later” options, and seamless mobile payments are just the start though.

New UE regulation, Payment Services Directive 2, forced banks and financial institutions to implement modern solutions to fit into the regulations affecting their systems’ security, privacy, operation, or management. Depending on the country, the process was quicker or slower. But the effects are already visible. Thanks to the digital revolution, companies from the finance industry can now partner with Fintech companies from all over the world and work together on creating a better banking experience for the customers.

Soon, it might also be possible for the customers to pick a financial service coming from a different place than they are just as easily as signing for a local one – and that’s all thanks to open banking.

Linear Journeys will shortly be dead.

Customers’ expectations have changed over the years. They are no longer happy with just visiting the bank or calling whenever they want to check their account. No, now they expect banks to provide an omnichannel experience for them so that they can use their funds, track profits, or manage their data, anywhere and anytime.

It’s also why assuming that all customers will behave in a linear manner is no longer feasible. Rather, banks and financial institutions should give customers the option to use the banking services however it is convenient for the users.

And this is one of the key things API banking will change – it will concentrate multiple financial services in one place so that customers can have quick and easy access to all their data, even from different banks or providers.

What else could financial institutions do here? Mobile app and web app creators specializing in FinTech could integrate banking into numerous 3rd party applications, letting users use their mobile devices far more efficiently. That way, customers won’t have to go to a physical bank to make a money transfer or set up a subscription – they can make a payment anywhere.

Consumers nowadays want to be able to use their funds as easily and seamlessly as possible, so from a technical perspective, API banking is a must-have for all financial institutions.

Banking API as a source of centralized data for the Artificial Intelligence

Integrating multiple services into one place and gathering user data from there can drastically improve institutions’ ability to find more about the customers and then build a complete profile of their customers. But the vast stream of data can be just as useful for teaching Artificial Intelligence-powered tools how to process and understand each of the customer’s needs.

Thus, AI could be a great asset to the financial sector, helping them segment and convert consumers, predict business trends, and recognize issues or challenges. What’s more, AI could free the employees of some manual, tiresome tasks (like manual lead scoring, risk, or assessment) and also manage big data for them, letting companies tailor their service to each and every customer.

Since the AI potential hasn’t reached its limits yet (more like we are just starting to learn about its full capabilities), we can expect to find even more uses for Artificial intelligence in the banking industry in the future.

Conclusion

Giving your customers a superb experience is now virtually a must, especially if you want to keep customers using your financial services. And taking advantage of API banking technology is currently one of the best ways to give them easy access to those. Several top banks have already launched their API services, and many others are expected to do the same soon – so if you want to gain a competitive edge, you should start thinking about introducing banking API’s to your business.

However, if you are unsure where even to start, why not let us help? At Crustlab, we are experienced in implementing banking APIs, so we understand both the development process and the strict compliance law. Soon, you might have your own app – and can reap the benefits.