Best Mobile Payment Gateways: How to Choose and Integrate Mobile Payment Gateway

These days, almost every mobile app has a payment gateway solution integrated. Why? Because customers appreciate the convenience of paying with just a click rather than logging into their bank accounts or typing in their credit card information.

Choosing the right mobile payment gateway is crucial for businesses looking to streamline their transactions and enhance customer experience. As the digital wallet becomes more prevalent, selecting and integrating a payment gateway that fits your needs can seem daunting.

In this article, we’ll guide you through the key factors to consider when choosing the best mobile payment gateway and provide practical tips on how to integrate it smoothly. Let’s dive into the world of online payment systems.

What Is a Mobile Payment Gateway?

A mobile app payment gateway is a technology that facilitates the processing of financial transactions through mobile devices. A payment gateway connects a merchant’s mobile application or website and the payment networks processing transactions. It ensures that sensitive payment information, such as credit card numbers, is securely transmitted from the customer to the acquiring bank, using encryption to protect data from unauthorized access.

Payment gateways are crucial for businesses operating in the digital space, enabling them to accept a variety of payment methods including credit and debit cards, mobile wallets like Apple Pay for an iOS app and Google Wallet for Android apps, and even the BLIK service, which allows users to pay for their purchases using only the user’s mobile banking app and a unique 6-digit code.

Given the capabilities of payment gateway solutions, there’s little surprise they’re frequently integrated into various mobile apps requiring instant transactions, like, for instance, mobile commerce to facilitate online payments.

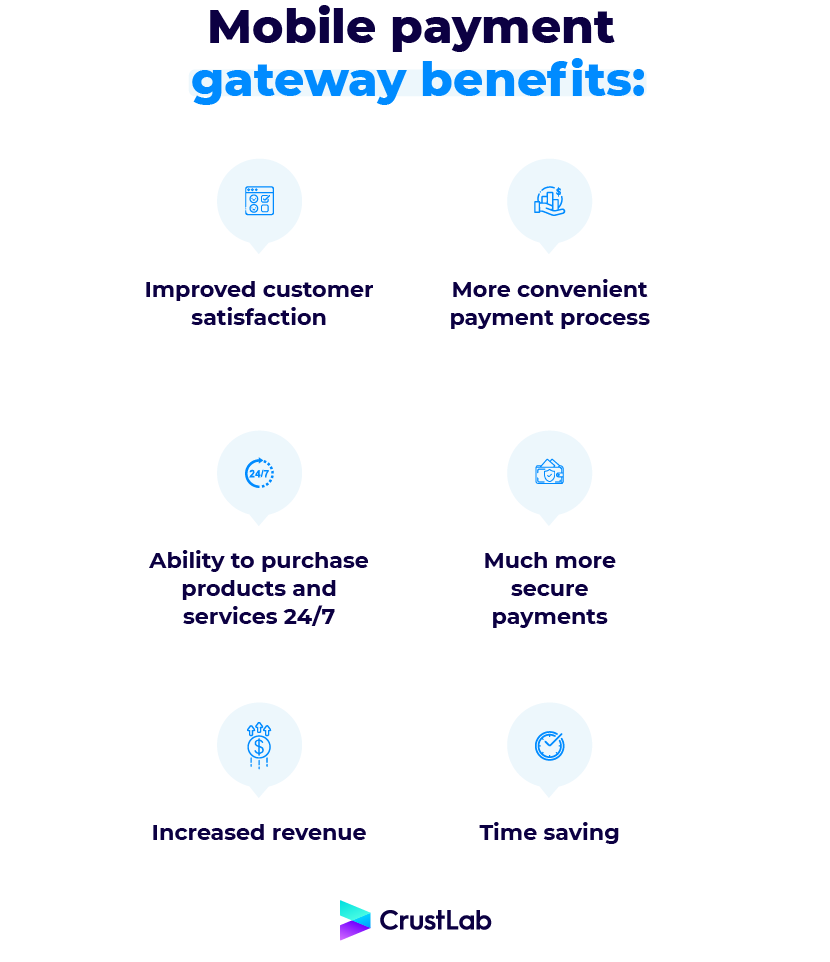

What Are the Benefits of Using a Mobile Payment Gateway?

What makes mobile app payment gateways so valuable? First of all, in-app mobile payments are incredibly convenient. Users can complete transactions quickly and securely within the app environment, without the need to switch between different platforms or enter lengthy transaction data multiple times.

For businesses owning mobile apps, that means:

- Improved customer satisfaction thanks to a much more convenient payment process and the ability to purchase products and services 24/7.

- Increased retention rate and consumer loyalty as clients enjoy their shopping experience without leaving a mobile application.

- Much more secure payment processing as the data transmitted between the app payment gateway and the financial institution that accepts online payments are encrypted and passed through fraud detection tools. Digital wallets also provide extra layers of biometric authentication such as fingerprint scans and/or facial recognition incorporated into mobile apps, assisting businesses in ensuring payments aren’t fraudulent.

- It takes payment processing off your shoulders, as they are automatically either approved or denied.

What should make you, as a business owner, interested in integrating payment gateway software is that they also reduce the risk of fraud:

- The customer’s card information or bank number is encrypted while being transmitted to the payment gateway, so only the customer and their bank which accepts payments know the entire number.

- A payment gateway must be compliant with PCI DSS standards, which means it must follow specific security standards to guarantee the security of your customer’s card information.

- Card services provide an additional security protocol called 3-D Secure that requires the customer to use a one-time password for every card they use to make an online payment.

How to Choose a Mobile Payment Gateway

When deciding on a payment gateway for your mobile app, it’s important to consider multiple factors to ensure you select the best option for your business needs. The market offers a variety of payment gateway services, each with its own set of capabilities. To choose the right mobile app payment solution, assess the features that are most crucial from your business perspective.

Type of Merchant Account

While choosing from multiple payment gateway solutions, it’s key to consider whether a given mobile app payment gateway requires a dedicated merchant account or operates on an aggregator model.

A merchant account is a type of bank account specifically for holding funds from card transactions, which then transfers the money into your business bank account. This setup often offers greater control over transactions and might provide more favorable processing rates, but typically involves a more complex setup and stricter approval processes.

On the other hand, an aggregate merchant account (like PayPal or Stripe) pools transactions from multiple businesses under one shared merchant account. This model can be quicker and easier to set up, making it ideal for startups and smaller businesses that want to start accepting mobile payments without the delays or the rigorous screening involved in setting up a dedicated merchant account.

Type of Payment Gateways

Before selecting a mobile app payment gateway, it’s crucial to understand the three main types available and their compatibility with your business model:

- Redirect Gateways: These direct users to the payment service provider’s platform to complete transactions, simplifying security and payment processing for developers but potentially disrupting the user experience and lowering conversion rates.

- On-site Checkout, Off-site Processing: Users input payment details within your app, and data is processed on the gateway’s server. This method balances a seamless experience with reduced security responsibilities.

- On-site Payments: This method manages both data collection and processing within your app, offering maximum control over user experience and fast processing times but requiring strict security measures, including PCI DSS compliance, which can be costly and demanding.

Payment Gateway APIs

Payment gateway APIs are crucial for seamlessly incorporating payment functionalities into mobile apps, enhancing both control over the user experience and the ability to monitor conversions effectively.

Different payment gateways might utilize their proprietary APIs or integrate third-party APIs, depending on their infrastructure. It’s important to select APIs that offer comprehensive insights into payment transactions, helping you optimize the payment process and improve user engagement with your platform.

Multi-currency Support

If you’re planning to expand your business internationally, you should consider what currecies your chosen mobile app payment gateway support. Multi-currency support in payment gateways enables businesses to accept payments in various local currencies, facilitating global reach. This simplifies international transactions by allowing customers to pay in their preferred currency, improving the shopping experience and potentially increasing market penetration for businesses expanding overseas.

Customer Support

While searching among various mobile payment gateway providers, focus on those who provide robust customer support. This will ensure you have the necessary help available when dealing with any technical issues or transaction disputes.

Security

Every payment gateway solution should make money transactions not just simple, but also secure. How can you recognize secured transactions?

First and foremost, look for gateways that employ strong encryption methods, such as SSL or TLS, to protect data during transmission. Additionally, ensure the gateway is compliant with PCI DSS, which sets the minimum security standards to protect cardholder data. Another indicator of a secure transaction is the presence of multifactor authentication, which adds an extra layer of security.

Which Payment Gateway Provider Should You Choose?

Before we dive into how exactly you can conduct an app payment gateway integration, let’s talk about which one you should even choose – because you have several options. Here, the best idea is to note down your needs and then compare the payment gateway providers to see which one would fit your business best.

What choice do you have? Here are the most well-known payment gateway providers on the market.

Stripe

With Stripe, merchants can build branded payment pages, create custom transaction reports or invoices, and more using the built-in developer tools. A machine-learning fraud detection system is also available, along with 24/7 customer support. Stripe accepts all major payment methods and over 135 types of currencies, together with local payment methods.

Key features include advanced security measures like PCI compliance, 3D Secure technology, and an extensive API for custom integrations, which enable businesses to adapt the payment processing system to their unique needs.

Stripe’s pricing model includes a fee of 2.9% plus $0.30 per successful card charge. Additional fees apply for international cards and currency conversions

PayPal

PayPal offers two payment gateway options suitable for global commerce: Payflow Link and Payflow Pro. The former, which carries no monthly fee, provides a PCI-compliant hosted checkout solution on PayPal’s servers, ideal for businesses seeking a straightforward setup. The latter, for a $30 monthly fee, offers extensive customization of the checkout process, including advanced fraud protection and recurring billing options for an additional cost.

Both gateways charge a $0.10 transaction fee and support major credit cards, digital wallets, and e-commerce platforms, making them ideal for businesses looking to expand internationally. They are available in the US, Canada, Australia, and New Zealand, catering to various business needs with secure and efficient payment processing

Braintree

Despite not being as robust as other providers, Braintree integrates with a wide range of e-commerce platforms and supports various payment methods including major credit cards, digital wallets, ACH deposits, Venmo, and PayPal. It allows transactions in over 130 currencies and offers features like recurring billing, customer information management, advanced reporting tools, and APIs for customization.

Braintree ensures transaction security through PCI compliance, data encryption, and activity monitoring. The fees are set at 2.59% + $0.49 per transaction for cards and digital wallets, and 0.75% for ACH deposits, capped at $5.

Amazon Pay

If you already sell your products on Amazon, Amazon Pay may be a good payment gateway provider for you as with it, users can complete their transactions using just their existing Amazon Pay account. It can also integrate with popular e-commerce platforms like Shopify, BigCommerce, or Magento- their supported payment options are limited to the most popular credit cards only though.

Amazon Pay does not charge a setup fee, but it takes a 2.9% + $0.30 cut on all domestic transactions. That number jumps to 3.9% for international transactions.

Skrill

Skrill offers significantly lower transaction fees than other payment gateways – for some payment methods, you won’t pay a fee at all, and for others, the fee is as low as 1%. The rates depend on the country though. What’s more, Skrill supports over 40 currencies and 100 payment methods – even cryptocurrency. Skrill can also process international payments at a rate of 1.9% per transaction.

Skrill gateway is compatible with over 20 of the most popular eCommerce shopping cart solutions, including WooCommerce, Magento, Shopify, PrestaShop, etc. To pay, users must have a Skrill account with a linked credit or debit card, though.

How to Add a Mobile Payment Gateway to Your iOS or Android App?

Now getting to the details – how exactly can you add a payment gateway to the apps? If you have already chosen your future gateway provider, then you should head to their main page and look for a page with implementation instructions. Each service provider has its own set of software development kits (SDKs) to use and often, also has detailed instructions on how you can add the integration. The general steps are the same for both Android and iOS apps:

- Integrate Server-Side and Client-Side SDKs,

- Connect to API,

- Apply for a payment security certificate.

This last stage is crucial as your server is directly involved in processing payment details and so must conform to PCI-DSS standards as well. To obtain this certificate, you must go through two steps. In this case, the first thing you need to do is evaluate all your information systems that hold card data and fix any problems found. After that, your organization will undergo an audit by one of the PCI Security Standards Council companies, after which your company will be certified, and you can begin accepting payments.

Another thing you should look at is making your app PSD2 compliant. PSD2 is focused on improving the security of all electronic payments while also making it easier for customers to access their banking data – you can read more about it in our previous article.

As for the technical steps – below, you can find links to some of the payment gateway integration instructions, both for iOS and Android system apps.

How to Add a Payment Gateway for Android

- Stripe Integration SDK for Android

- PayPal Integration SDK for Android

- Braintree Integration SDK for Android

- Amazon integration SDK for Android

How to Add a Payment Gateway for iOS

- Stripe Integration SDK for iOS

- PayPal Integration SDK for iOS

- Braintree Integration SDK for iOS

- Amazon Integration SDK for iOS

As you can see, the instructions are pretty long and detailed – and require specific coding skills. If you are familiar with using SDK, know how to work with API, and also understand the compliance requirements, then you might try adding the payment gateways yourself. But that might both take far more time and effort than you would like – especially if you encounter some unexpected problems during development.

If you aren’t confident enough in your skills or don’t have enough people on your team to handle the integration yourself (or simply want to ensure the payment will be 100% compliant with all financial regulations), it’s a better idea to hire a development agency to assist.

Choosing an agency means you’ll have a partner who has experience adding payment gateways to various types of apps, as well as someone who knows exactly what can go wrong – and how to prevent it. But they can also help you create a smooth UI for your app, take care of the maintenance, and suggest how you could improve the safety of your mobile app payment gateway.

Our in-house team of FinTech industry experts has a wealth of experience when it comes to developing financial software and currency exchange apps, as well as integrating payment gateways into mobile apps. By complying with regulatory requirements, such as CIS, NIST, and SOX, they can also ensure the safety of your app users’ documents and personal data.

A few of the projects we worked on involved adding a payment gateway:

Wrapping It All Up

Giving your app users an option to pay for a product or service anytime they like and at the click of a button is virtually a necessity now. For that, you need a payment gateway integration. But which one should you pick out of the plethora of providers? With so many options, it’s easy to get lost and end up implementing a gateway that doesn’t offer the features you need, or the one having a number of hidden fees.

That’s why we recommend getting professional advice on this matter from software development companies – both to save your time but also your money and nerves. Since CrustLab has been in the FinTech space for years, our developers can easily recommend a payment gateway provider that best fits your business and then help you with the integration.